The Tax Cuts and Jobs Act (TCJA, also known as the Trump Tax Cuts) was signed into law in December of 2017 by President Trump. Because of the way that tax law is structured (it is usually not permanent), it leads to frequent conversations about what to do with this or that aspect of tax laws. I expect that this year will be no different as our politicians decide what to do with it. While it’s likely that Republicans (who have slim majorities in the House and the Senate) will be able to pass something to extend the TCJA, there’s obviously guarantee of that, nor is there a guarantee as to what exactly they’ll put in this new bill.

To help prime you for this conversation and help you understand what’s at stake, I’ve put together 5 facts about the law, as well as 3 common myths.

Facts About The Trump Tax Cuts

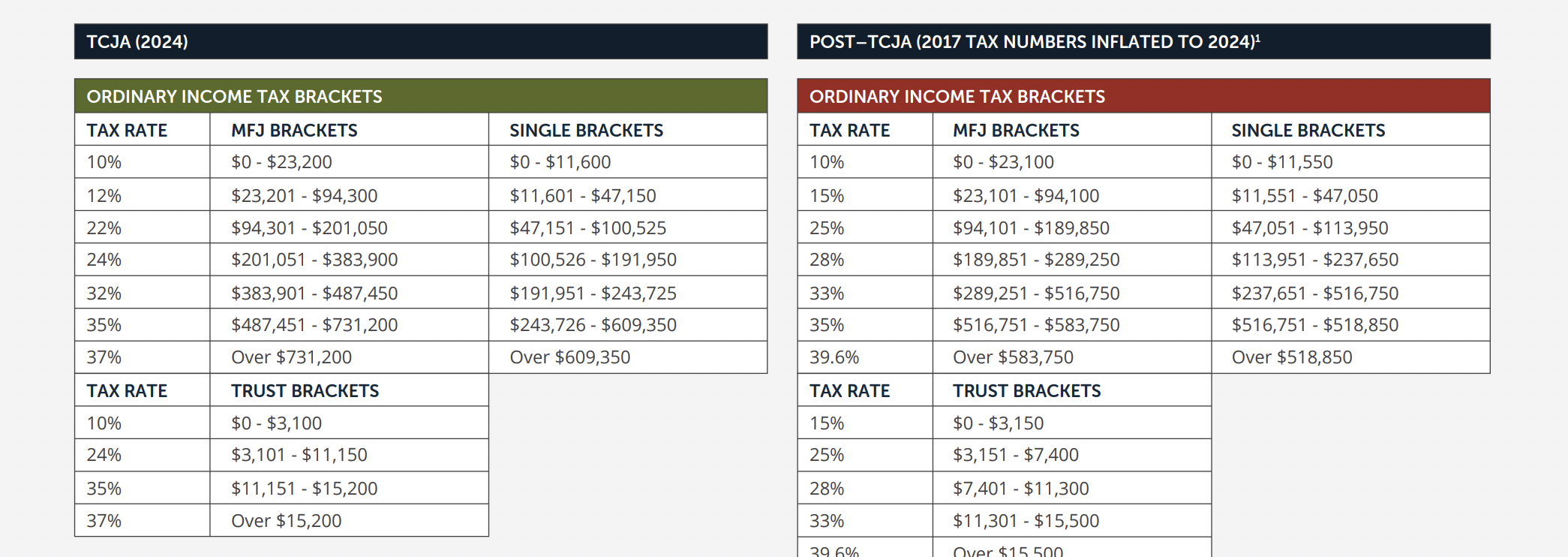

1. It lowered individual tax rates from 2018 until the end of 2025. That means that if Congress and the President do nothing, the tax rates will expire at the end of this year, and in 2026 we will go back up to the previous, higher tax rates. We’ll go through what the actual rates are now compared to what they were before in point 3.

2. Corporate tax rates are not set to change – they were permanently lowered in 2017 from 35% to 21%. Trump may want to lower it more but I’m personally not sure if he’s going to get it included as the priority may be for individuals to get their’s extended (or lowered permanently). So my guess is that that stays at 21%.

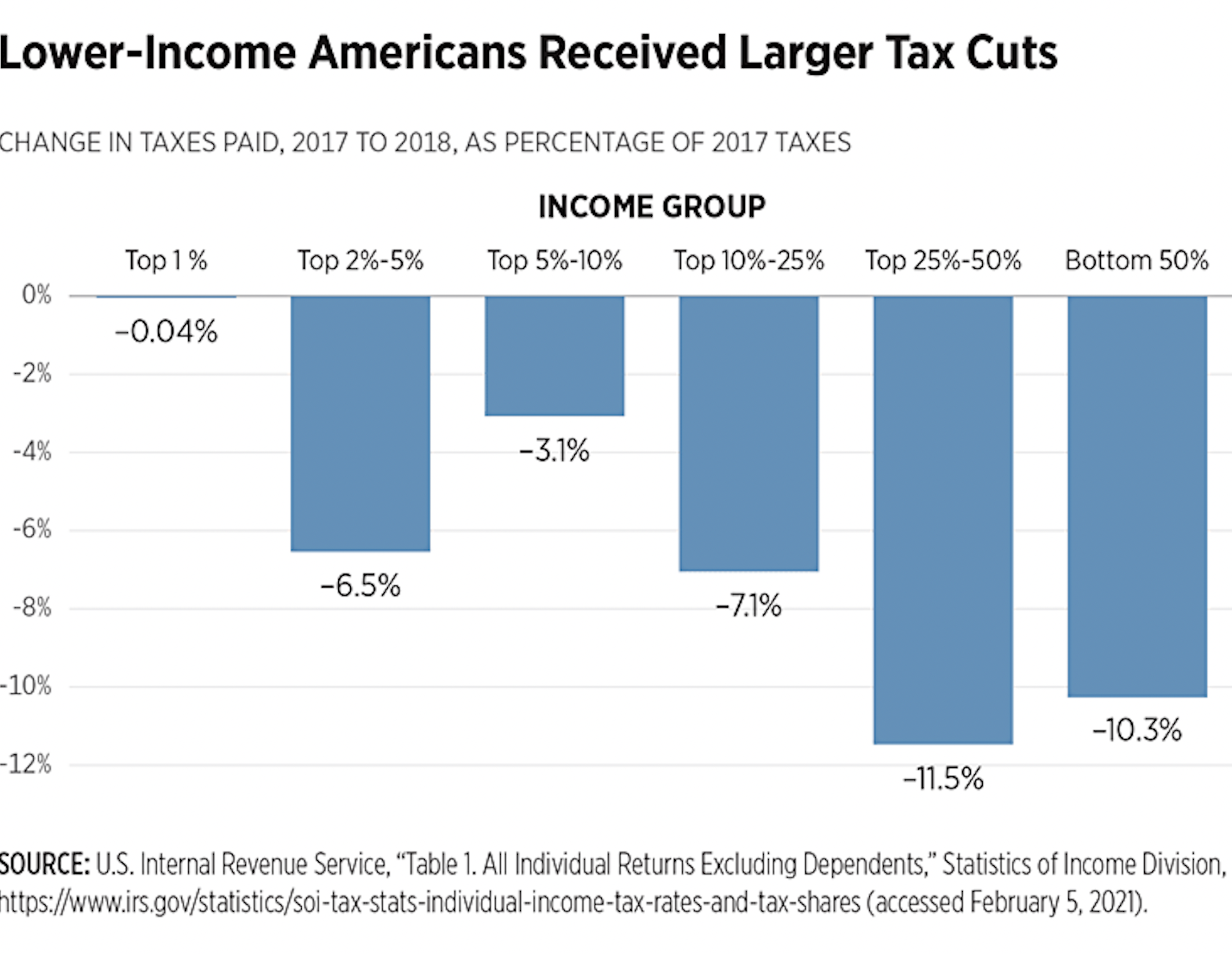

3. Almost everyone, at every income level, had their tax rates lowered with this bill. You may hear some say it was only for the rich, but that’s not true. It did benefit high income earners, absolutely, but it also benefited middle income and lower income earners as well.

Let’s look at the chart below, for Married Filing Jointly, and assume that couple is making $90K. On the left are the tax rates with the Trump Tax Cuts, on the right are what the rates would have been in 2024, without those tax cuts. If you were making $90K under the Trump tax cuts, a large bulk of your income would be taxed at that 12% level. But if the tax cuts didn’t go through, then that same couple at that same income would be paying income at the 15% rate. That 3% reduction for a couple making $90K would mean a tax savings of around $2,100. That’s a big deal!

Now, it is absolutely true that the rich did benefit from this as well. The bill lowered the tax rates that you pay at every tax bracket. Which means that if you were making $500K, you got to pay a lower rate, at every income bracket, by a margin of 2-3%. And obviously if you’re talking 2-3% reduction on a number as large as $500K, that’s going to be a significant benefit. So high income earners did benefit, but they weren’t the only ones.

4. The standard deduction doubled in size and as a result less people itemized their taxes. Without the trump tax cuts, the 2024 standard deduction (adjusted for inflation) would’ve been $7,850 per person. But with the tax bill, the 2024 standard deduction is $14,600. Now that is an amount that you can use on your tax returns to lower your taxable income, and everyone is able to use that. So that benefitted everyone, and disproportionately helped lower and middle income people the most.

Because if you’re making $500K and you can lower your taxable income by an extra $7K, that might be nice, but it’s not a huge difference. It’s a 1.4% difference. However, if your taxable income is $60K, and you can lower it by $7K, then that $7K in lowering your taxable income is a 12% difference. So that standard deduction increase is a much bigger deal for people with incomes in a more normal range. This change meant that instead of around 30% of people itemizing their deductions (and not taking the standard deduction), the number dropped to around 10% that itemized after the TCJA was signed into last.

Last note on this point: If the TCJA is not extended, the standard deduction will reduce to the previous amount, which would essentially equate to a tax increase for most people.

5. The TJCA doubled the child tax credit from $1K/child to $2K/child. This would also go back down to the previous level if it not extended at some point this year.

Myths About The Trump Tax Cuts

1. Only the Wealthy Benefited – While high earners benefited, middle-income and lower income households also saw lower tax rates, a higher standard deduction which resulted in a lower federal tax bill than they would have had otherwise.

2. The TCJA Broke The Budget/Caused the Rising Deficit

Many politicians like to blame our deficits, which are an issue, solely on these tax cuts. Now the problem with that is that revenues actually rose after the TCJA were signed into law.

2017 (Pre-TCJA): Revenue: $3.32T, Spending: $3.98T, Deficit: $665B

2018: Revenue: $3.33T, Spending: $4.11T, Deficit: $779B (+$130B spending)

2019: Revenue: $3.46T, Spending: $4.45T, Deficit: $984B (+$340B spending from 2017)

2020 (COVID impact): Revenue: $3.42T, Spending: $6.55T, Deficit: $3.13T

In my not so humble opinion, rising government spending played a pretty significant role in deficit expansion. Lastly, and this is tough because it’s a counterfactual, but some budgetary experts, like the Congressional Budget Office, think that revenues would have been higher without these tax cuts. That very well might be true, but I think it’s hard to dismiss how dramatically government spending has increased.

3. Charitable Giving Suffered Because of TCJA

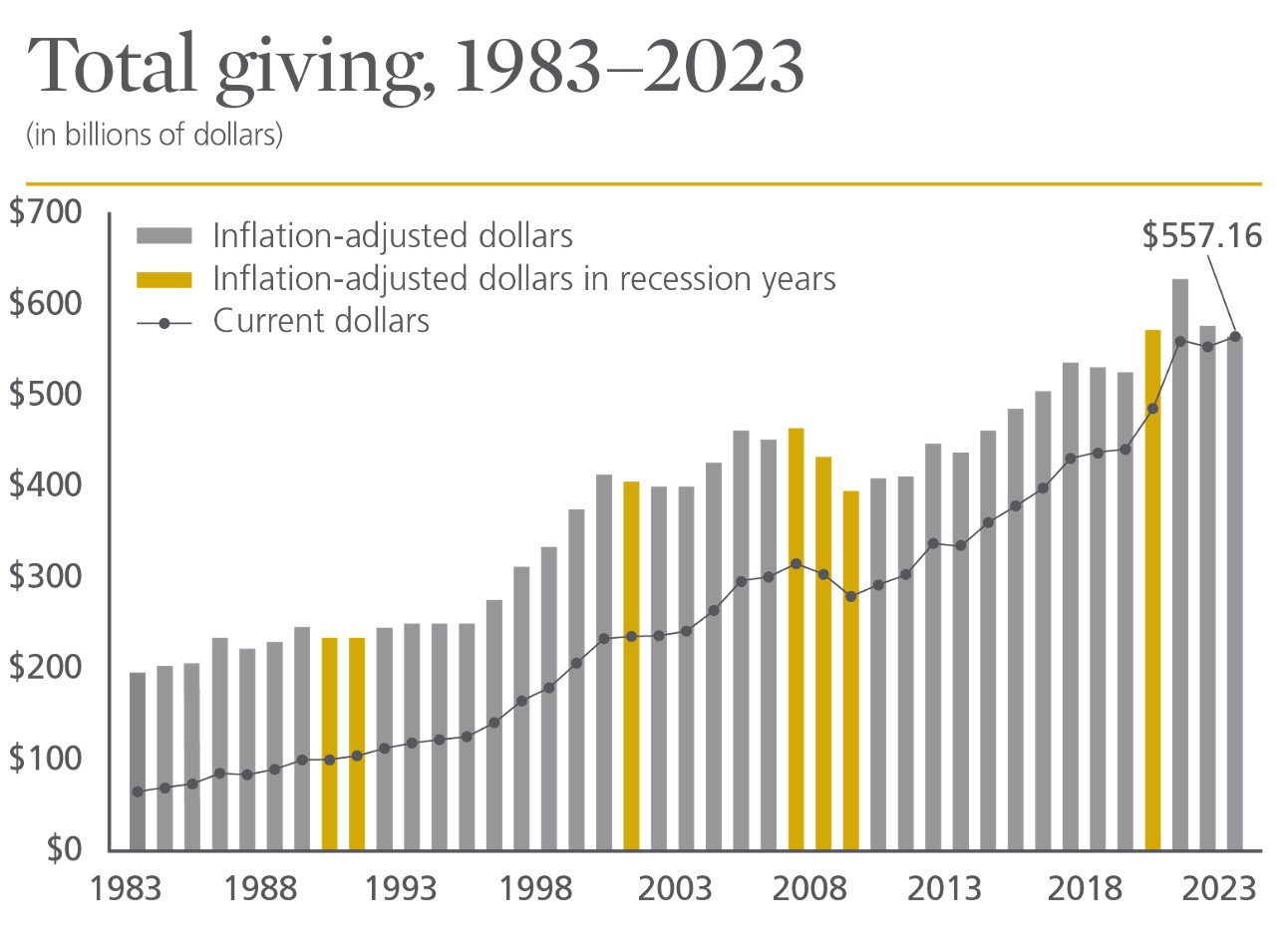

This is actually a mixed bag. As said before, the standard deduction increased which meant that less people itemized their taxes. And what’s one of the benefits of itemizing your taxes? You get to count your charitable donations as one of those tax deductions. But if less people are itemizing, the thinking would be that less people would giving to charities since they don’t get a tax benefit. And that has actually borne out into reality. From 2017 to 2018, charitable giving fell by about $20B dollars, according to Indiana University.

But over the last 8 years, charitable giving has rebounded. The most recent year we had 557.16 billion in charitable giving, compared to $424.74 billion in 2017. So why did it rebound?

So what changed? In short, corporations, whose profits margins increased because of the lower corporate tax rate discussed previously, increased their charitable giving. While individuals, who were less incentivized to give, gave a smaller share of their income than they did previously.

So this is a half myth. Charitable giving has changed, but there was not a precipitous fall in donations.

Looking Ahead

As we go through the rest of 2025, the legislation that I’m most looking forward to watching is this one. The lower tax rates, the expanded tax brackets (allowing more income at certain levels), and the higher standard deduction have been very favorable to my clients. I personally hope they can pass something that keeps most (or all) of the items I’ve listed here. If, and when, something gets close to the finish line in terms of being signed, I’ll be sure to make a new blog post and lay out those details at that time.