As you approach retirement, managing your savings and investments becomes one of your top priorities. You want to make sure you have enough saved, have the right investments, a solid distribution strategy, and more. But one thing that you can’t overlook is your responsibility to handle something called Required Minimum Distributions (RMDs)—mandatory withdrawals from certain retirement accounts once you reach a specific age. Failing to take these distributions on time can lead to significant penalties. In this post, we’ll break down what an RMD is, when you need to take it, and how to handle these distributions throughout your retirement.

What Is An RMD (Required Minimum Distribution)?

One of the key characteristics of Traditional IRAs and 401(k)s is their required minimum distributions once you reach a certain age. With these retirement accounts, the IRS mandates that you withdraw a specific amount each year. The amount of your required minimum distribution (RMD depends on your account balance, your age, and the distribution period defined by the IRS – which basically corresponds with your life expectancy). In other words, they want you to withdraw that money over the course of your life, so that they can then tax it.

Failure To Take Your RMDs

Previously (prior to 2023), the penalty for failing to take an RMD was 50% of the amount that should have been withdrawn. This was one of the steepest penalties in the tax code.

The current penalty is much more lenient, but still could be costly. Starting in 2023, under the SECURE Act 2.0, the penalty has been reduced to 25% of the amount that should have been withdrawn. Additionally, if the failure to take the RMD is corrected in a timely manner (typically by the end of the following tax year), the penalty can be further reduced to 10%.

When To Take Your RMDs

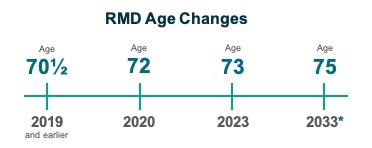

You must calculate your RMD each year and separately for each of your tax-deferred accounts. Note that the age at which you must begin taking RMD has recently changed a lot over the last 5 years. Previously, if you reached 70.5 by 2019, that was your RMD age. Then it increased to 72 for a few years. And now, if you turn 73 in 2024, you will need to take your first RMD by April 1 of 2025 and then another one by the end of the calendar year. So in this situation (turning 73 in 2024, taking out your first RMD by April 1 2025) it would require 2 RMDs in 2025. And then every subsequent year, you need to take it by December 31st. Of course, you don’t have to wait until April 1st of the following year to take your first RMD.

I should also add that the RMD age will increase to 75 years old starting in 2033.

Here’s a helpful graphic that shows how the RMD ages have and will change (courtesy of Ascensus):

How To Calculate Your RMDs

RMDs apply to tax-deferred retirement accounts, such as Traditional IRAs, SEP IRAs, SIMPLE IRAs, 401(k)s, and 403(b)s. However, Roth IRAs are not subject to RMDs during the account owner’s lifetime. Starting in 2024, Roth 403(b) accounts are also no longer subject to RMDs, thanks to the SECURE Act 2.0. Prior to 2024, Roth 403(b)s had RMD requirements despite withdrawals being tax-free accounts. Another change in the SECURE Act 2.0 is that Roth 401(k)s no longer require RMDs in 2024.

RMDs do not apply to taxable brokerage accounts (like a joint or individual or Trust investment account), or to savings accounts.

For instance, if your IRA was worth $100,000 at the end of last year, and your divisor from the table is 25.6, your RMD would be $100,000 / 25.6 = $3,906.25.

Tips on Taking Your RMDs

Now that you know the basic rules of RMDs and how they work, I do have a few tips on how to handle them once you decide to take it.

1. Don’t Keep It Invested Throughout the Year

When it comes to taking your RMD, it can be easy to simply forget about it, especially if you want until the end of the year to take it out. While some financial advisors recommend taking it out in installments throughout the year, it can be easy to miss an installment. I tend to like the idea that you calculate and withdraw their RMD at the beginning of the year, so it is done and over with.

While it’s true that your investments could see growth during the year, the risk of forgetting and the subsequent penalty if you do forget far outweighs the gains that you could realize. Further, there could be a decline in the value of the stock market throughout the year, which means you have to sell more shares to withdraw the same dollar aount.

On the other hand, if there is a steep decline in the markets in December or early January, it could make sense to hold off taking your RMD at the beginning of the year and instead waiting.

2. Put It In a Separate Account

Managing a large sum of money can be difficult, especially if you need to make it last an entire year. Two solutions work well to avoid overspending and finding yourself out of money by the end of the year.

The first solution is to keep your RMD in cash (after selling your stock/bond funds) in your investment account and set up monthly distributions or installments. Setting monthly distributions through your investment account means that 1/12th of your RMD will be available each month, helping you budget better without running out of funds.

The other option is to move your RMD to a separate savings account. Depending on the type of savings account and the terms available, you may get a higher yield on your money than if you simply keep it in your investment account. Again you can set up a monthly distribution with this account into your primary checking account. Doing this will help you stick to your budget and not overspend.

3. Use a Cash Bucket

It can be tempting to take your RMD and put it directly into an investment to maximize your return. And that could make sense if you don’t need the RMD money to live off of. But many people do need those funds to live, and in that cash, I really think you should keep it in cash. Anywhere from 12 to 24 months of cash in checking/savings/money market accounts is a solid idea for retirees. And if you don’t know how much you’re spending on a monthly basis, that’s really something you need to determine ASAP, because all your retirement planning depends on that.

You Don’t Have to Figure It Out Alone

RMDs are just one piece of the broader retirement income puzzle. Along with making sure you take your required distributions, you also need to determine the right overall withdrawal strategy, manage your investments, and ensure your money lasts throughout retirement. Balancing these elements can be challenging, especially with changing tax laws and market fluctuations. But you don’t have to navigate it all on your own. If you’d like help crafting a personalized plan that includes your RMDs, tax strategies, and investment management, I’m here to guide you through it. Feel free to book a call with me here to discuss your retirement goals.