One of the things that I get asked about the most – especially since I work with young professionals whose careers are taking off and they are finally adulting – is buying a home. And with real estate prices sky high in places where I work with clients (I’m looking at you Culver City and La Jolla), I have to say there are times when it makes more sense to rent than buy.

I know that’s not what we’re used to hearing. Most of the commentary, especially here in the US, is that rent is “throwing money away.” After all, when you own the home, you are paying off your mortgage every month, and when you rent you are paying off someone else’s mortgage. Why in the world would you choose to pay off someone else’s mortgage when you could pay off your own?!?

But there are a few things missing in that equation, so let me try to explain.

When It Makes More Sense to Rent Than Buy

-You don’t have a big enough down payment. If you can’t make a sizeable down payment, it’s going to cost you. If you don’t come to the table with 20% down, you’re going to pay something called PMI, Private Mortgage Insurance. This isn’t to protect you, it’s to protect the lender in case you can’t pay your mortgage. And you’ll be paying somewhere between .5% – 1% of the loan amount in PMI.

Assume you bought a “cheap” home in Southern California for $500,000, and had a 5% down payment. You’ll be looking at an extra $1,400/year on PMI, on top of everything else you pay owning a home. And again, that money isn’t paying down your mortgage one cent, it’s solely going to the lender.

-If you have to deplete your emergency fund to cover your down payment. If you have to severely deplete most – or heaven forbid – all of your emergency fund for your down payment, you are asking for trouble.

What happens if something in the house (roof, foundation, HVAC) needs to be repaired? What happens if you get in a car accident and need a new car? Or have a major medical issue? Where is the money going to come from if you’ve used it all for your down payment?

If you get anywhere lower than 3 months of an emergency fund, after funding your down payment, you simply don’t have enough cash to buy. Save up for a little bit longer before you make the jump.

-You’re buying a home because you think it’s a good investment. I know a lot of people think that owning real estate is a great investment, and that home prices always appreciate. After all, they aren’t building any more land, right?

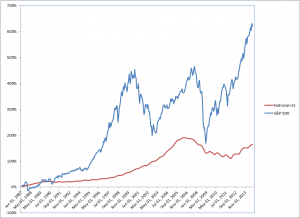

The truth is, though, that if you’re looking to build wealth over the long term, the stock market offers much better returns than real estate. Don’t believe me? Take a look at this chart comparing returns from the stock market and real estate from Robert Shiller, a Nobel-Prize winning economist:

So in 26 years, the S&P 500 (the largest 500 companies in the US) grew by over 600%. In the same time period the US housing market grew by 150%. Still a decent return, but nowhere as good at the stock market. So if you’re just trying to make a good investment, I’d encourage you to pass on real estate and instead put more money into the stock market.

None of this is meant to persuade you that buying a home is a terrible idea. There are a multitude of good reasons why one would want to buy a house. Things like stability, family memories, and control over living space bring tremendous comfort and joy. But there are times when it makes more sense to rent than buy.

What do you think? Are you considering buying a home? Or are you happy renting? Send me an email at scott@dev-forthrightfinances.pantheonsite.io and let me know your thoughts.