We all search for people to learn from that we hope to eventually know, like, and trust. Especially when it comes to the complex financial world we live in. Instead of trying to figure it all out ourselves, it makes all the sense in the world to seek out experts who can help us understand the financial world around us. As a result, many of us develop an affinity to these so called financial experts. They are people we’ll never meet, but can follow along with via newspapers, podcasts and videos, and the array of social media options at our disposal. While it can be a good idea to get a wide variety of insights from various people, it also presents an interesting dilemma.

First, is this financial expert actually an expert? Or are they simply excellent entertainers, known for generating a buzz around their TV or Radio shows?

Does their financial advice contain any conflicts of interest? For instance, is their financial “recommendation” conveniently the exact same thing they’re selling?

Or do they excel at giving journalists juicy quotes which they know will generate buzz for the article and will make the journalist’s life easier? If they’re good at that, is there any repercussion when they’re wrong? Does anyone ever call them out or even care, so long as enough people continue to read the article?

At the crux of this issue, in my mind, are misaligned incentives. For the entertainer, they aren’t trying to increase your net worth, they’re trying to get podcast downloads or TV ratings. The financial guru who makes baseless predictions that turn out to be wrong more often than not, don’t face any ramifications for their poor guesses, but love the attention each of those media hits gives their ego.

But enough generalities, let’s go into some recent offenders:

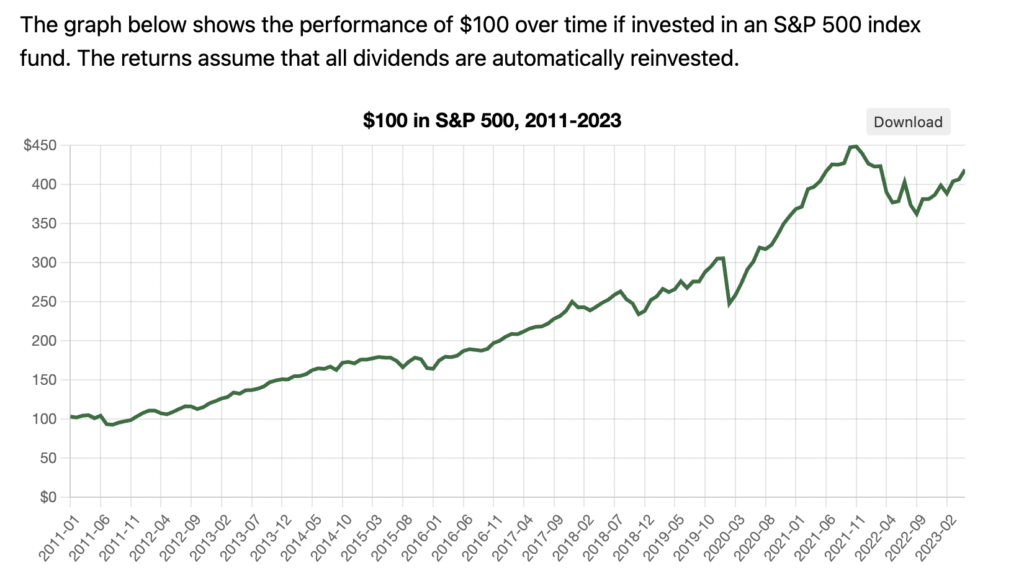

Mark Cuban: Mark is the owner of the Dallas Mavericks, a billionaire, and since 2011 has been an “investor” on Shark Tank, a popular CNBC show where “Sharks” investor in start up businesses featured on the show. With over a decade of investing in these ventures, you would think that Mark has been making some solid gains (especially consider the incredible run the US stock market has had from 2011 to 2023, where the S&P is up over 300%)! Let’s hear how Mark has fared over that same time period:

Yes, you heard that right. Cuban, after 12 years on the show, hasn’t made any money at all for his role as an investor (although I’m sure he’s made plenty by being a show participant). Now I don’t have anything against Mark. My point goes far beyond him: Most people on TV, most business shows on TV, aren’t to help you become a better investor or to become richer. They simply want to entertain you. If they do that, for them, mission accomplished. So make sure you can differentiate between actual investment education and investment entertainment.

Two more things: Just because he created a great business that he later sold for tons of money, does NOT mean that he has an expert advice in terms of how to invest. We know he doesn’t, because his investments in Shark Tank haven’t made him a single dime.

Also: just because you’re investing in something new and unique (like you see on Shark Tank) doesn’t mean that it’s actually going to make you money. There is absolutely nothing wrong with a “boring” index fund. In fact, if Cuban had invested all of his extra funds into some index funds, instead of the Shark Tank ideas, he’d financially be much better off.

Next up: Janet Yellen and Jerome Powell

Janet Yellon is the Treasury Secretary, and Jerome Powell is the Chairman of the Federal Reserve. Needless to say, they have a lot of input on our economy and what goes on at the federal level. Unfortunately, just because they hold high positions of power and influence, that does not mean they know what’s going on in the actual economy. For years, they’ve downplayed, misstated, or completely underestimated the very real and painful inflation that hundreds of millions of American’s were facing.

In March of 2021, Yellen called the risk of inflation “small” and “manageable,” and in May of 2021, “I don’t anticipate that inflation is going to be a problem.”

Powell continually insisted that inflation would be “transitory,” and thus kept interest rates near zero. It wasn’t until March of 2022, with CPI at 7.9%, that Powell finally threw in the towel and rose inflation. Of course, he did this right after the start of the Russian invasion of Ukraine, and causing even more investor anxiety and fear. While it’s hard to prove a counterfactual world, it is easy to imagine that had Powell had his nose on the ground more, and saw what people were experiencing in their daily lives for over 2 years, he could have taken a more gradual approach to interest rates that didn’t include the rapid increase we saw in 2022.

The lesson? Just because a “financial guru” is appointed to a position in DC does not mean they actually know what’s going on with the economy, nor does it mean they know what good policy is. They can be just as dumb with financial decisions as the average American (no offense to the average American).

Third on our list: Dave Ramsey.

Full disclosure: I like Dave Ramsey. A lot! If every 22 year old starting out of college followed his Baby Steps in the book The Total Money Makeover, the financial stress and anxiety people feel would fall dramatically, and society as a whole would be much better for it.

Yet the guy isn’t perfect, and when you have to talk about finances 3 hours a day for 25 years, you’re bound to get things wrong.

Last year, he was asked “What Should My Retirement Withdrawal Rate Be?” His answer: Invest in 100% stocks. Assume you get 4% inflation and a return of 11-12% year, and you can safely take out 8% per year.

The math adds up, doesn’t it? You get a 12% return, but inflation is 4, so now you’re at 8%. Then you take an 8% distribution, and you’ve broke even. Sounds great, right? So what’s your problem Scott?

My problem is that if people take his advice, and then they get a bad 5 to 10 years of stock market returns, they could completely implode their retirement. The technical term is sequence rate of return, and it refers to how bad returns in the first few years of retirement have a significant impact on how long your portfolio will last.

On the other hand, if you get great returns the first 10 years, your odds of outliving your money have just gone up. But of course we don’t know any of that when we retire, which means we can’t just assume we’ll get an unrealistically high 12% rate of return in retirement (and speaking of which, I hardly come across retirees who are willing to invest in 100% stocks, which is the only way you’d come close to 12% returns).

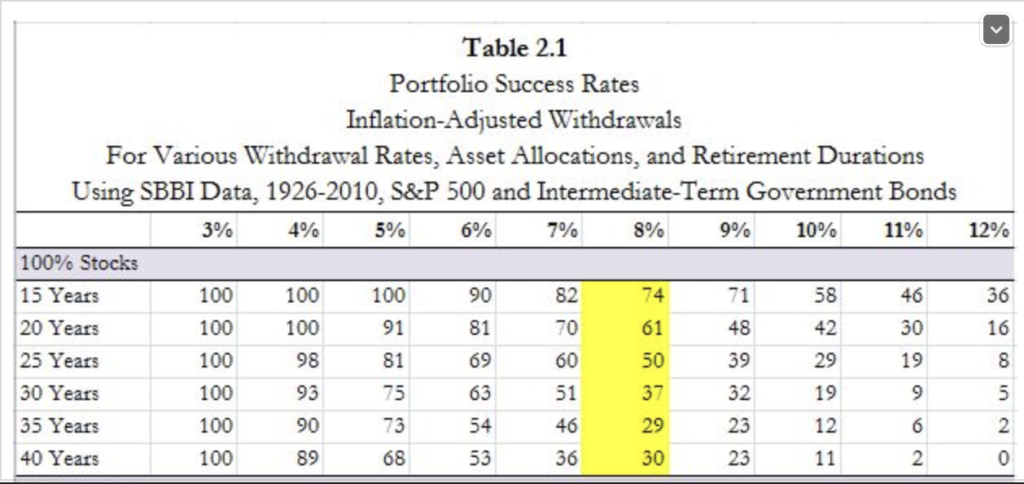

Below, you can see an academic study that spans almost 90 years, that shows the probability your portfolio would last a given period of time, depending on your withdrawal rate. Note the section in yellow, which highlights Dave’s standard 8% distribution.

If you plan/hope to live 20 years in retirement, are you comfortable with a 61% chance of having money at the end? How about a 50% chance if you live 25 years? I don’t know a single retiree who would be comfortable with that. But I do know that Dave makes good radio, and is a skilled communicator. Even when he’s not presenting the most useful or educated point of view.

Last up is Ray Dalio, a famous hedge fund manager. Ray makes a number of media appearances on a regular basis, where he pontificates about the economy and investing landscape. But just because he makes lots of media appearances doesn’t mean you should take what he says seriously. Let’s circle back to September 2022, when he said if interest rates rose to 4.5%, the stock market would fall another 20% (in addition to the negative returns 2022 had already experienced to that point). Over the next 9 months, the stock market grew 13.6% despite the Fed’s interest rate rising to 5 and 5.25%. Even moreso, in June of 2023 Dalio recommended investing in the stock market! Only 9 months after saying he would stay away from the stock market if rates increased above 4.5%!

Do you see what’s going on here? Dalio can and will make whatever prediction he wants in the fall of 2022, knowing that the media needs his quotes and predictions, and people like to listen to them and pretend that he’s giving them wisdom. I actually know people who didn’t want to invest in 2022 because of him! In other words, he cost real people money they actually needed, because of his fear-mongering. Yet no one in the media will call him out on his awful predictions, because they want him to continue coming on their shows. They don’t care if he’s right or wrong, they care if they get the viewership they need to keep their jobs.

Does this make any of them bad people? I don’t think so. I think they’re performing their jobs as well as they can, but their job isn’t to make you money, and it’s certainly not to give you good investing advice.

Do you want good investing advice? Invest in low cost, well diversified index funds, don’t let your political beliefs influence your investing decisions, don’t sell when the market is down 20% or more, and don’t you dare watch CNBC on a daily basis. Go outside more, spend more time with friends and family, accept that you aren’t the next Warren Buffett, and go save the time you spend worrying about investments on something more enjoyable and worthwhile. If you do that, you might have a thing or two you can teach the financial “experts.”