Don’t put all your eggs in one basket. If you’ve been researching investments for any length of time, you’ve probably heard that admonition. You might also have heard – “there is no free lunch – except diversification. That quote is attributed to economist Harry Markowitz, who won a Nobel peace price for his work on something called Modern Portfolio Theory. In other words, this idea of diversification is highly revered, even among the higher echelon of investment advisors and economists.

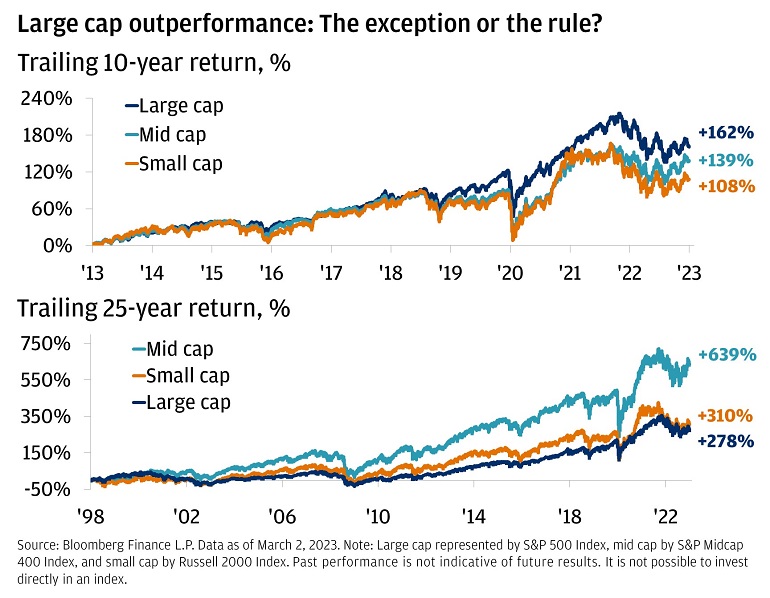

But, even the best advice is not always going to be followed, especially when there is some evidence to the contrary. For instance, the last few years, and even the last 10 years, have not necessarily made a great case for diversification. In fact, if you’ve been diversified the last few years or decade, that means you likely missed out on more gains you could’ve had by not being diversified.

What am I talking about? I’m talking about the outperformance of large sized companies, and the relative underperformance of small sized, medium sized, and international companies.

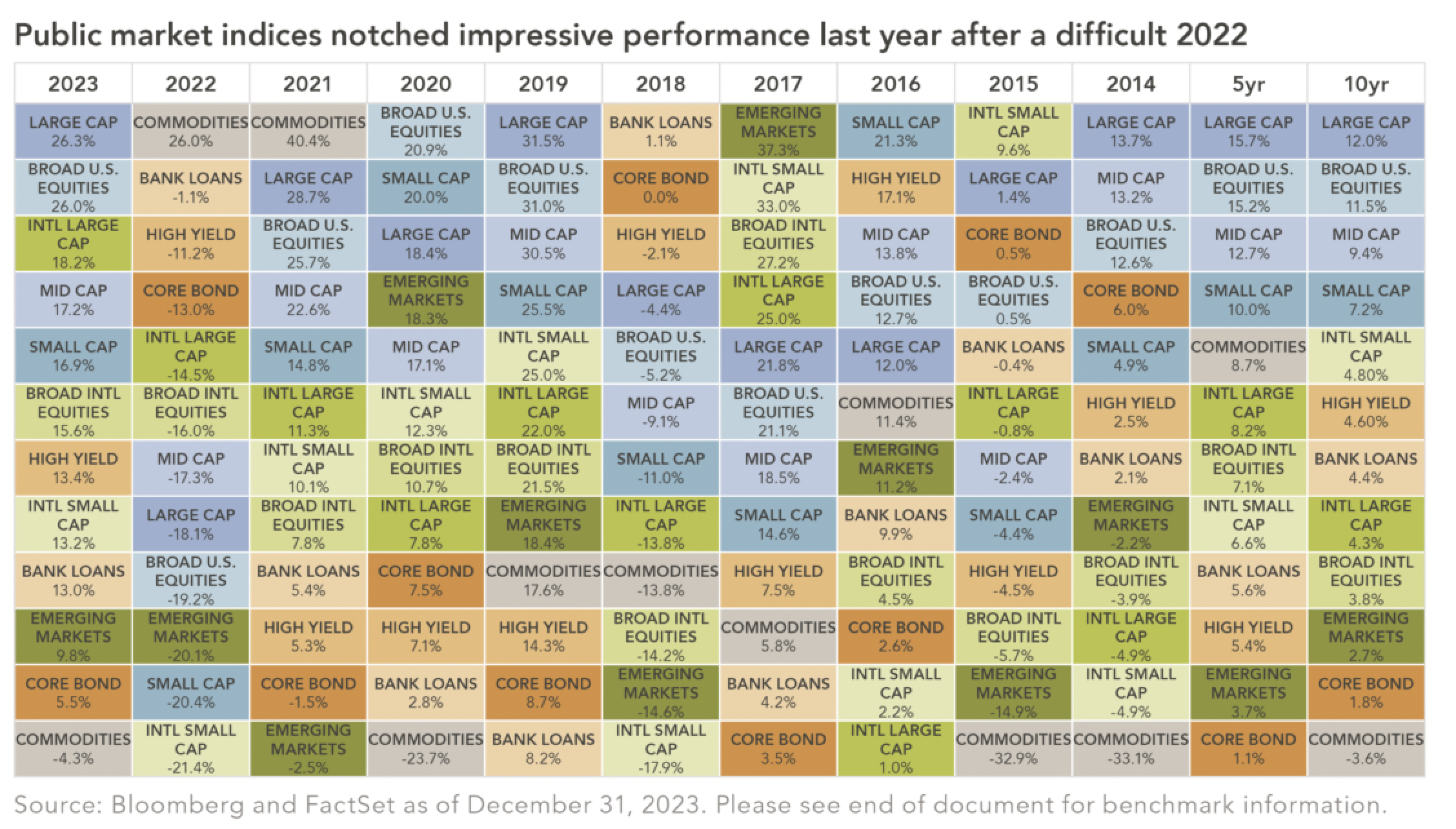

Last year in 2023, large cap companies outperformed all other asset classes with an incredible 26.3% return, while small and mid cap companies in the US, and international equities, got between 15 and 17%. So that’s a pretty solid outperformance.

But it doesn’t just stop there. If you look at the last 10 calendar years, large cap stocks have outperformed all other assets classes in 5 of those 10 years. And the chart that I’m sharing, for those of you on the podcast, shows 12 asset classes. So it’s pretty incredible for one asset class to do that 5 years out of 10.

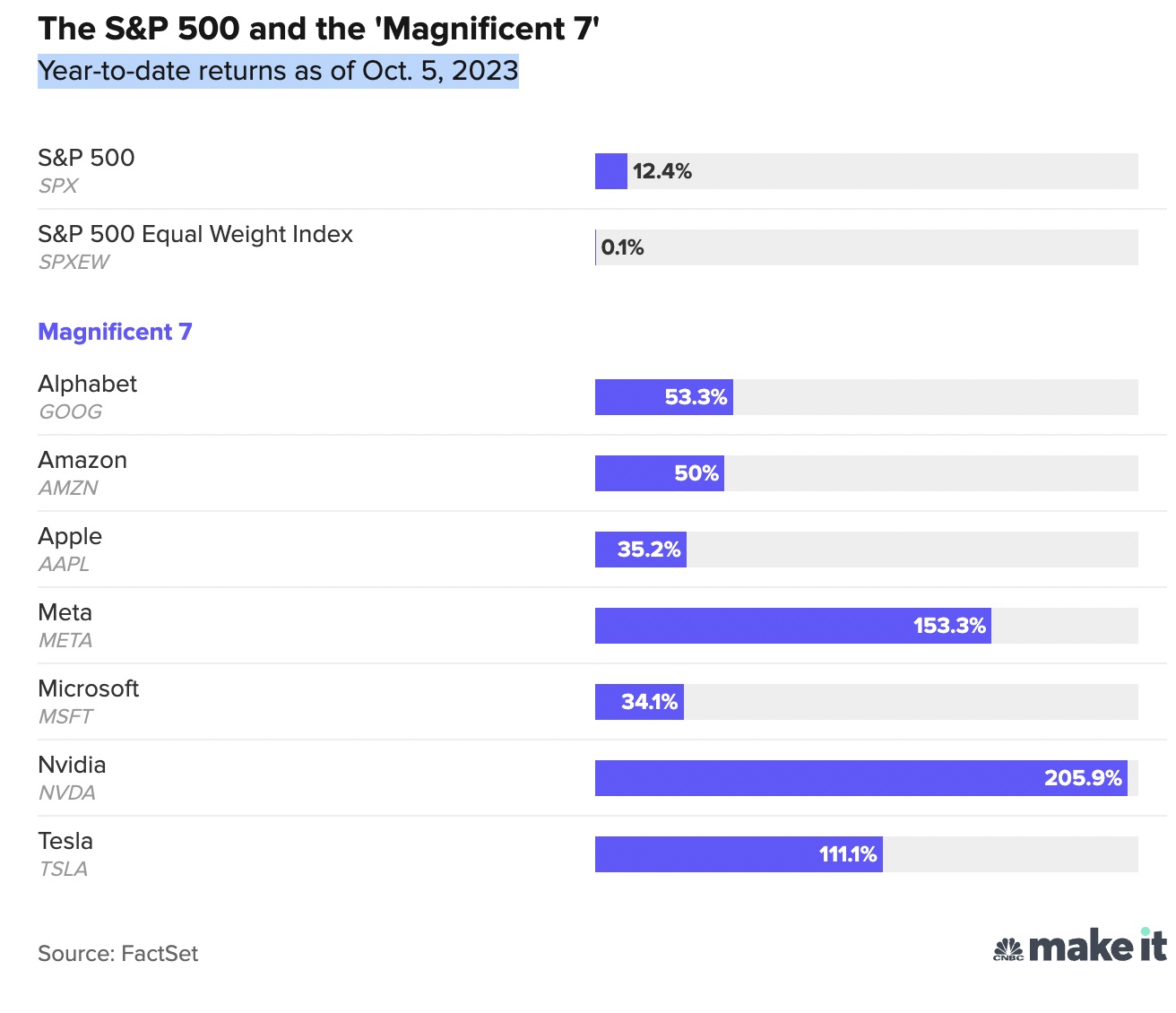

And when people see that outperforming from a large size companies, when they see the returns of Nvidia, Meta (formerly Facebook), Amazon, Tesla, Alphabet (formerly Google), and others, it’s easy to say to yourself, why not just put all my money in large size companies? Why not put all of my money in these 7 large size companies that are drastically outperforming all other investments?

But the difference in returns don’t just end there. When you look into the details of the large cap returns, we see that in 2023 that large size growth oriented companies – growth oriented basically means companies that are trying to grow as quickly as they can, and are not overly focused on paying out a dividend or getting stable cash flows, but more focused on increasing overall revenue, when we look at those companies, we see that those companies earned a whopping 42.7% return last year. While large size value companies, companies with more stable revenue, more consistent cash flow, companies like Walmart and target, Home Depot and Lowes, those companies only earned 11.5% last year.

Screenshot[/caption]

Screenshot[/caption]

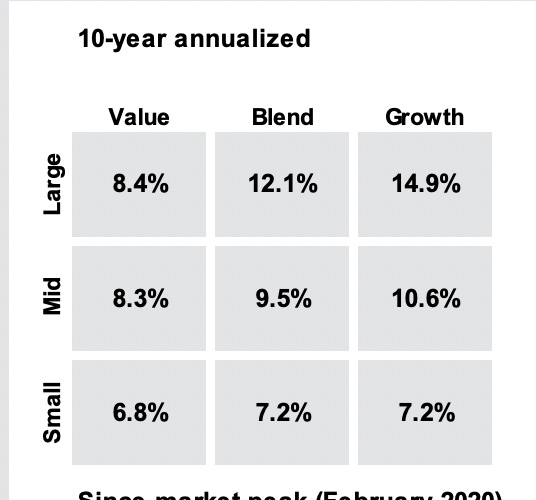

And when we look back over the last 10 years, the trend is the same, with large size growth earning an annual rate of 14.9% while large size value only earning 8.4%.

Screenshot[/caption]

Screenshot[/caption]

So what is my point? My point is that there has been a very clear “winner” over the last decade and that winner isn’t just large size companies, but specifically large size growth oriented companies.

Further, if you have been diversified in large, medium, small size and international companies over the last 10 years, you have missed out on the higher returns you would have received had you only been invested in large size growth companies.

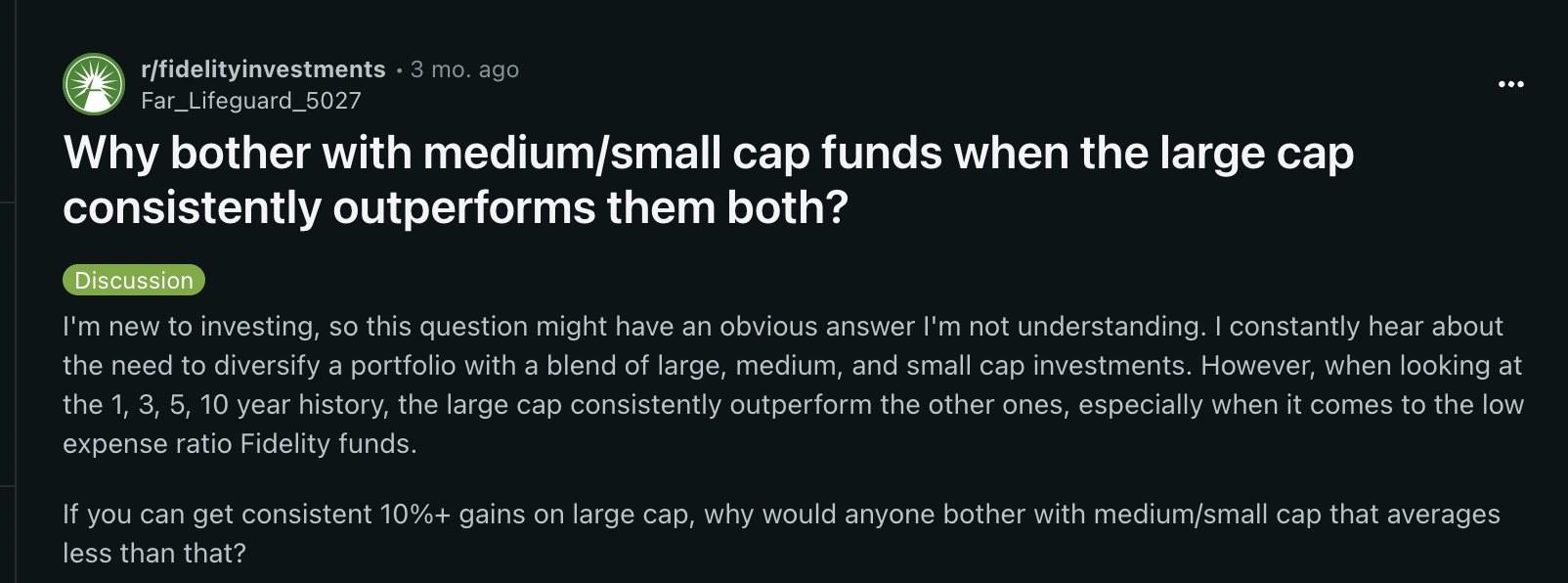

When people realize that, and they see that trend happening over time, which is surely has, that leads people who I meet with, to ask the question: Why are we still diversified? We are underperforming by not having more in large cap. Here’s a question from Reddit’s Fidelity Investment group:

First of all, I do want to say if you’ve been diversified, you’ve still done well, just not as well if you had everything in large size growth companies. Secondly, I have to admit that this criticism of diversification is factually true. We did miss out on higher returns because we were diversified.

I’m not sure who said this first, but there’s an old adage that goes “Diversification means having to say that you’re sorry.”

So yes, I am sorry to all the dozens of people who actually listen to me who I told to be diversified. BUT, my dear listener? Do you remember what the investment markets were like in the 2000s? Were you invested then? If you don’t remember, let’s take a walk through memory lane and see what your returns would’ve been had you had 25% in large cap, 25% in medium cap, 25% in small cap and 25% in international funds.

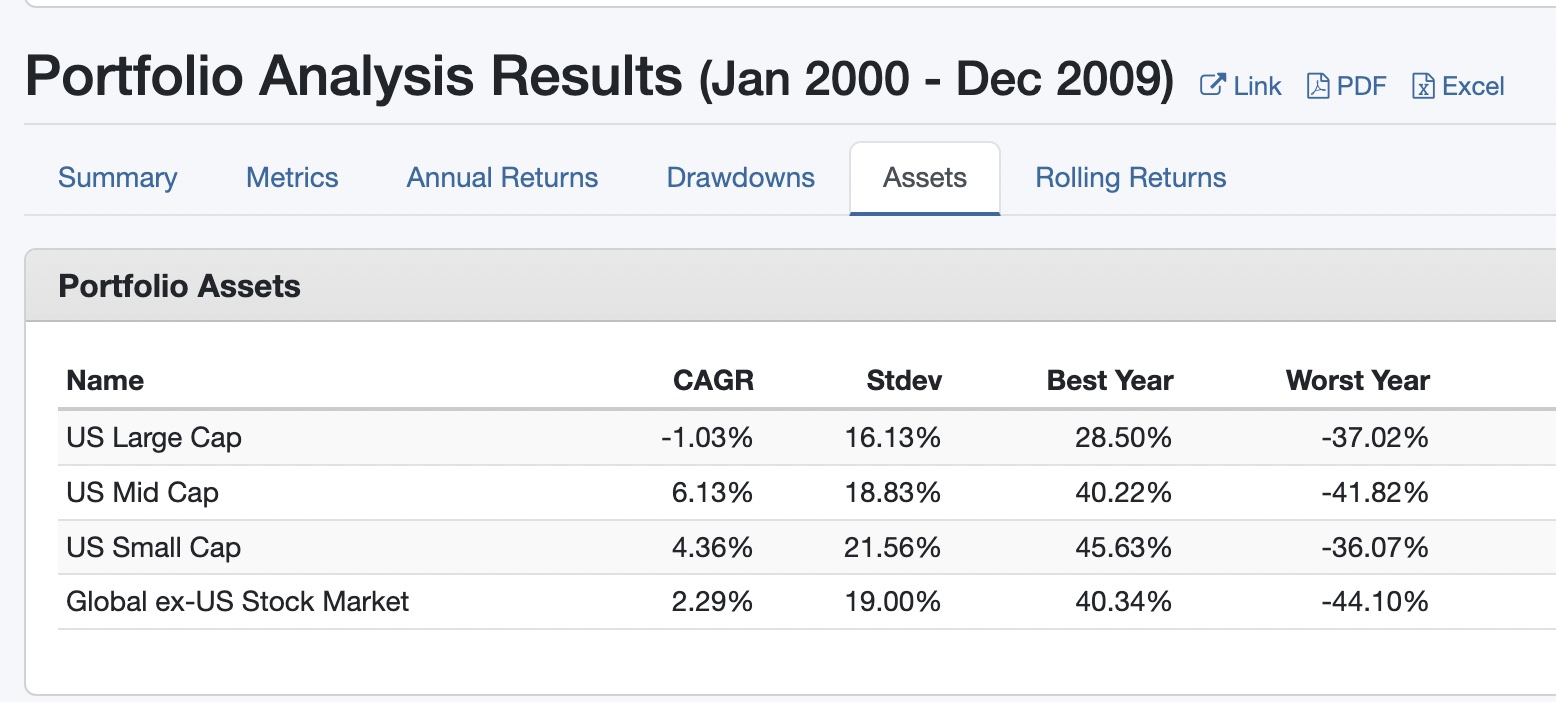

When you use a website called Portfolio Visualizer, and put in the allocations I just mentioned, here’s what we get:

Large cap is the biggest loser, losing an annual 1.03%

Mid Cap got a solid 6.13%, small cap a modest 4.38% and international got 2.29%. So in the 2000s, we have mid cap and small cap both doing better than large cap. So obviously if you were only in large size stocks in the 2000s, you’d be in a world of hurt, as your investments lost money, while a diversified portfolio would’ve done much better.

And if you push the chart back to show the last 25 years, from 98 to 2023, we see that mid cap did best, then small cap, then large cap.

So whenever you see people insisting that large cap is all you need, that these large trillion dollar companies are going to take over the world, you need to know that these people are making their decisions because of recency bias. The idea that whatever has happened most recently will happen well into the future.

Yes, large cap has done exceptionally well the last few years and the last decade. And it absolutely makes you want to hit yourself on the head for quote unquote, missing out on being all in on large cap (even if your portfolio on a whole has done well).

But give yourself a break: you have no idea what will outperform in the future, and neither does anyone else. So when you’re putting your portfolio together, just own all of them.